"Not your keys, not your coin" (or why you should get your Bitcoin off Coinbase)

The first time I purchased Bitcoin was back in 2014 on Coinbase. At the time, I thought it was "funny money." The only reason I bought Bitcoin was because I wanted to convert it to Dogecoin and send it to the Jamaican bobsled team in the Sochi Olympics. In other words, I was bored on Reddit.

I distinctly remember feeling like it was a chore to setup my Coinbase account. If I remember correctly, I needed to connect my bank, make a small deposit, and wait days before I could start making purchases.

Shortly thereafter, one of the biggest Bitcoin exchanges was hacked (Mt. Gox). I lost interest in the space as I didn't feel confident that my purchases were actually safe. I lost focus on Bitcoin and went and took the FE Exam instead.

In the rest of this post, I'm going to try to convince you that you need to remove your Bitcoin from exchanges like Coinbase, and why you need to take actual ownership over your own property.

What does "not your keys, not your coin" actually mean?

Bitcoiners will frequently say things like, "not your keys, not your coin." But what does that even mean? Let me explain as simply as possible.

What are the keys?

The keys is a reference to your private key, which controls access to your Bitcoin and allows you to transfer (or spend) it. This is like a password that gives you the ability to use the Bitcoin you own.

If you purchase Bitcoin from Coinbase, you do not have access to your private key. The private key is NOT your Coinbase password!

When you purchase Bitcoin on an exchange like Coinbase or Gemini, the Bitcoin you own is stored alongside other people's Bitcoin on a wallet that the exchange owns. The exchange holds the private key, not you.

What is the coin?

The "not your coin" is referring to the Bitcoin that you purchased.

Putting it all together

"Not your keys, not your coin" means that when you don't own your own "password" to access and manage your Bitcoin, so you don't technically own your Bitcoin.

The exchange does!

You: "But I trust exchanges like Coinbase with my Bitcoin"

I get it. Coinbase seems like a legit company. They haven't been hacked like Mt. Gox. They are a public company too. They seem to care about security, and they have lots of engineers who work hard to keep the platform safe.

I can understand why you might trust Coinbase to store your Bitcoin instead of trying to remember a password (your keys) on a slip of paper. I get it. I lose stuff all the time, and the idea of losing my keys terrifies me.

That's not the point of the "not your keys, not your coin" though.

It's about managing risk. And it's also about being the boss of your own property.

There's no free lunch in life. There are risks and opportunities with every decision you make. Let's talk about the risks involved with holding your own keys compared to keeping it on Coinbase.

The risk of holding your own private key (it's you)

If you personally hold the keys to your Bitcoin instead of an exchange like Coinbase, you are taking ownership (or custody) of your own property.

If you lose your "password" to your Bitcoin, it's your fault, not someone else's.

When you hold your keys, you have complete ownership over your stuff, not someone else. In other words, you are taking personal responsibility. This may feel a little scary, but you are the boss.

The risks when Coinbase holds your Bitcoin

In this section, I'd like to show you how keeping your Bitcoin on Coinbase is more risky than taking complete ownership over your own keys. In boils down to two groups of people:

- Exchange risk (the risks of storing Bitcoin on Coinbase)

- Political risk (the risk of the government getting involved)

Let's chat about each of these risks below.

Exchange risk

If you store your Bitcoin on an exchange, you are trusting companies like Coinbase to keep your property safe. They may have a decent track record, but they could also be hacked like Mt. Gox was back in 2011-2014.

If you were a hacker and wanted to steal a lot of Bitcoin, who would you go after?

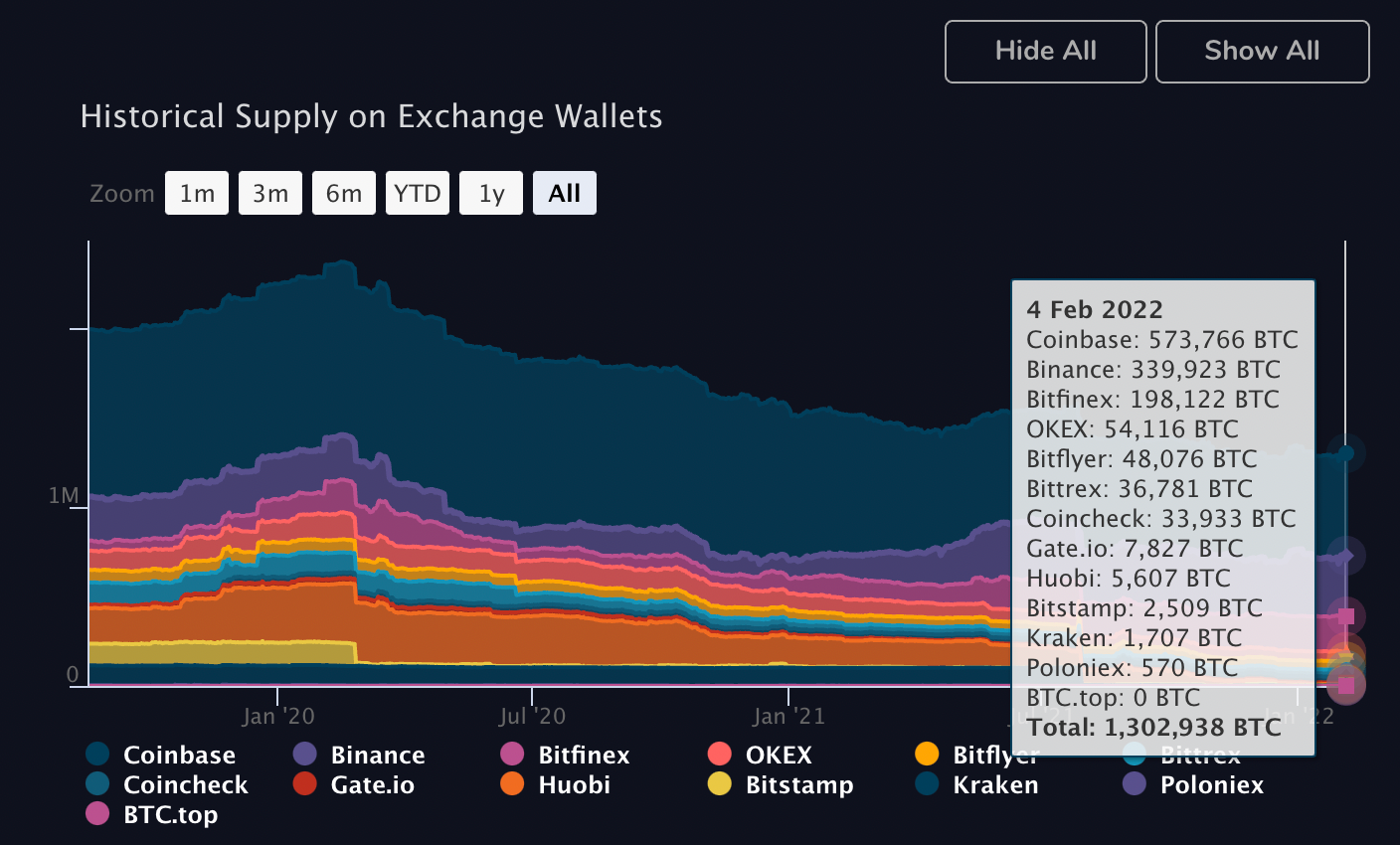

Maybe the exchange that holds (at the time of writing, 500k+ Bitcoin)?

In other words, exchanges like Coinbase are a pot of honey. And hackers are like Pooh Bear. They want the honey.

Political risk

Next up, you have political risk that you need to think about. What happens if the price explodes and the government wants some of that corn?

If they wanted your Bitcoin, where would the government go first? Maybe the exchange that holds 500k+ Bitcoin?

But that would never happen, right?

Well, it turns out, this has happened before, but with gold. And it wasn't very long ago!

Executive Order 6102: That time the US government took all the gold.

In 1933, President Roosevelt signed an order prohibiting "the hoarding of gold coin, gold bullion, and gold certificates within the continental United States."

At the time, the US was in the middle of a depression and the economy was struggling. The government wanted to print more money, but the money was backed by gold. So the government banned private citizens from holding gold, which allowed them to "raise" more gold, so they could print more money.

You can learn more in the video below:

It took 30+ years for this law to be changed btw!

This story is a cautionary tale that when times are tough, the government will do things that it needs to "for the benefit of all." Even immoral things like taking your stuff.

I'm not saying the government will take your coins, but it could happen. Just like a hacker may not hack Coinbase and steal your coins.

It may not happen, but it could happen.

In conclusion: it's more risky to store your Bitcoin on an exchange vs. holding your own keys!

When you store your Bitcoin on an exchange, you have multiple points of failure (the exchange and the government).

When you personally hold your own keys, you are the single point of failure.

Who do you trust more? The government? Some random employees at Coinbase? Or yourself?

"But I still don't trust myself to keep track of my keys. I lose stuff all the time!"

Me too. Fortunately, there are a variety of approaches you can take to reduce your personal risk.

1.) Use a mobile wallet (good)

You could store your Bitcoin on a mobile wallet, like Muun or Bluewallet. The upside is that now hold your keys, but the downside is that you could lose your private keys and your phone (in a boating accident or something).

This is the least safest option in my opinion, as you always have your phone on you. I lose my phone all the time.

2.) Buy a hardware wallet (better)

The second option is that you could buy a hardware wallet to store your Bitcoin instead of trusting Coinbase. There are many hardware wallet providers like Trezor, Ledger, Foundation, and more.

Hardware wallets look like a USB stick (seen below):

When you setup a hardware wallet, you must write down your "password" (the keys) and store it in a safe place, like a physical safe or lockbox.

If someone finds this password, they could technically access and use your Bitcoin, which is why you need to keep this secret!

The advantage of this approach is that you own your keys. The disadvantage is that you need to keep your password (keys) safe.

3.) Use a collaborative custody service (best, IMO)

The next option I prefer, because I don't trust myself. It's called collaborative custody.

In short, you can use a service like Casa or Unchained Capital to add an additional layer of security. These services use "multiple signatures", which means that you need multiple "passwords" to access and use Bitcoin.

For example, you can have 3 signatures (passwords), but only need to use 2/3 of them to access and use your Bitcoin.

In the event that you lose one of your signatures, you can still access and use your Bitcoin. The company (Casa, Unchained) doesn't hold enough of these passwords to be able to access and send your Bitcoin.

To add another level of security, you could store these passwords in different locations, like your parent's house. In this situation, you would need to visit multiple locations to be able to access and spend Bitcoin.

Wrapping up

Bitcoin offers the ability to finally own your own property. You should take advantage of this leap forward in humanity by holding your own keys.

Because if you don't hold your keys, it's not actually your Bitcoin.